tv Power Lunch CNBC December 27, 2012 1:00pm-2:00pm EST

1:00 pm

y, veterans and their families is without equal. begin your legacy, get an auto insurance quote. usaa. we know what it means to serve. it's time for final trade. joey, you are up? >> mr. murphy. >> adt. >> josh brown. >> buy johnson & johnson. >> there's more "fast money." the dow is off its lowest level of this day thus far it's down 120 points. it was down 145 at its lowest levels. keeping our eye on the cliff and the negotiations in d.c. follow me on twitter. "halftime" is over. the second half of your trading day begins now.

1:01 pm

the skies over capitol hill. what's going on there is landing like a led balloon on wall street. if you're losing money the last four days, you know who it is. senate majority leader harry reid says the u.s. is probably going over the fiscal cliff. he's planning a news conference. we don't have the exact time. when it goes, we'll go there. investors getting quite nervous. obviously the dow dropping below 13,000. the first time since early december. fear index is spiking the vick. what going over the cliff will mean for you and your money. we will talk about it this hour. airline stocks flying high sitting at 1 1/2 year highs. will it be smooth skies for the industry next year in 2013. phil lebeau has the report. how about housing? what a story housing has been this year. a milestone. home prices on track for their first year-over-year gain since 2006. is the worst finally over?

1:02 pm

some say yes, others say no. what does michelle caruso-cabrera say. >> tyler, let's drill down to the numbers you were talking about. only four hours to go until america goes over the fiscal cliff. the dow jones industrial average down 113 points. had been down 148 points. look at that as we come on the air back above 13,000 level, not by much. the nasdaq, the biggest decline. 33 points. below 3,000 now at 2957. actually, hasn't been below 3,000 before that. s&p lower by 14 points. a decline of 1%. 1405 so holding onto the 1400 level. president obama is back at the white house. all eyes are on senate lawmakers now. amam jabbers is in washington. >> reporter: president obama did cut his vacation short in hawaii. he has arrived back at the white

1:03 pm

house this morning. the president emerging from marine one. what he's going to work on here in washington is pretty much anybody's guess at this point. the senate came back into session this morning and senate majority leader harry reid took to the senate floor to explain that he thought a $250,000 and above extension of the tax -- bush tax cuts could, in fact, pass and he was extremely, extremely angry in ways that you really hear on the senate floor with the speaker of the house. take a listen. >> it's beings operated with a dictatorship of the speaker not allowing the vast majority of the house of representatives to get what they want. if the 250 would be brought up, it would pass. >> so harry reid there calling house speaker john boehner a dictator for not bringing a bill to the floor that would extend the bush tax cuts for all those who make less than $250,000 a year. now that bill if it was brought

1:04 pm

to the house floor would have to pass with democratic votes. speaker boehner has said that he wants to pass something ultimately that can be con by t done by the majority of the majority. >> i don't understand how you can call him a dictator when he can't get his own bill passed. that doesn't make any sense to me. if he was a dictator, he could have done it. >> what we're watching here is a lot of finger pointing. the house side wants the senate to do something. the folks on the senate side said, wait a second, john boehner is who to blame. at the white house, they're pointing their finger at capitol hill. there's a lot of finger pointing but not a whole lot of action. >> all right, eamon. thanks so much. >> you bet. as negotiations continue on washington, that is a bit of an overstatement, check wall street, the fear index is spiking as the markets drop. we're back above 20 for the first time in fact in five months. up 14% in the past week. let's get trading action here at the nysc. mary thompson joins us on the

1:05 pm

floor. this is a vulnerable point for the markets. traders have been saying they're going to make a lot of noise and it will get made up. >> suddenly it isn't. so we're having a bit of a reality check. the dow, the s&p and the nasdaq all negative. it's the lowest now of the month. the vix is spiking. moving above the 20 level for the first time in five months. we want to point out the last time we had this angst over what was happening in washington was in august of 2011 when we had the debt crisis and the subsequent downgrade. at that point the vix was well above where it is, more than twice where it is. so while the fear index is high, up 31% in the last session, it was not where it was two years ago. also if you look at the forward curve on the vix futures doesn't really suggest we're in for any kind of calamity. >> 20.3.

1:06 pm

>> that was in july. look at the february and april. they're actually -- well, april is just about even where we are now. february certainly doesn't suggest any kind of a plunge. >> no, doesn't portend any kind of craziness. thank you, mary. >> tyler. michelle, thank you. with senate majority leader harry reid warning we are going over the fiscal cliff, let's pose the question is it better if that were to happen. are automatic spending cuts perhaps what the country needs? josh bulk is a national correspondent with the fiscal times. josh, good to have you back. good to see you. >> good to see you. >> it's not all that bad if we go over the cliff. is there a good, compelling argument to make for doing so? >> there are compelling arguments to make for going over the cliff. it might create pressure for a genuine and real deal, not just with tax reform but spending cuts, but there's a lot of dangers in doing it. one of the big things that's screaming on my radar is the alternative minimum tax. that's a tax that is meant to prevent the wealthiest from

1:07 pm

escaping the irs altogether but unfortunately it was never adjusted for inflation. if we go over the cliff, the amt will kick in not just for 2013 but for 2012. and you've got 30 million americans that are going to face an additional $86 billion in taxes. >> if they don't fix that particular thing, not only will taxes go up for your 2013 bills, worry enough, but they will go up if you were subject to the amt for 2012 to the tune of 80 some billion dollars? >> that's right. that was money that was not withheld from your paycheck, was not used as tax estimates and that's going to cause families to face two choices. either, one, eat into their savings or, two, go into debt to pay their tax bill. and in scope and size that's roughly equal to what democrats were asking for on raising taxes on the wealthy. >> let's talk about the spending cut side of see questions administration.

1:08 pm

$500 billion or thereabouts. the numbers are all over the place. the only thing about see quest administration, it is a blunt action chopping at discretionary programs and so forth because congress could never hope to achieve those kind of budget savings if they were doing it voluntarily. >> that is one of the arguments. that is the u lis cease arguments, tying themselves to the mast. one of the more conservative republicans, jim jordan, told me the only thing worst than defense cuts are no cuts at all. that said, you can delay the impact of see questions administrati -- see quest administration. it will take them time to come up with the cuts over the course of the fiscal year. that said -- because we never passed the budget but only continuing resolution, we've only got until about march to figure out how to deal with that problem. >> you better believe that there are a lot of democrats in states like california, virginia,

1:09 pm

florida, in the senate and the house who don't want to see those defense cuts either because, boy, those are big employers. let me grill on one thing and that is this, tax rates are scheduled to go up anyway next year because of surcharges on medicare and a payroll tax surcharge because of obama care, am i right on that? >> you're right. if you look at it, incomes are really going to go back to where they were during the meltdown. the american economy will not have moved forward for many households. >> and the payroll tax holiday will end automatically. an immediate 2% cut to disposable take home pay. thank you, michelle? >> you say sequester, i say sequester. let's call it all off. >> the dow is trying to hold onto the 13,000 level. let's see if it can hold by 113 points.

1:10 pm

13.79 as it grows increasingly clear that they may not, probably cannot get it done. hamilt hampton pearson is here. >> we're down to, if you will, coffee cup politics. two simple words, rise above, on coffee cups and on cups of coffee at all 120 starbucks locations here in the washington area urging lawmakers and the white house to do something with these final days to get some sort of deal. about 500 cups of coffee on what is arguably a slow day just to get that message out, and what we're really finding in talking and spending a lot of time with the folks here, it is a message that's resonating with customers. >> the general public and america have lost a lot of faith

1:11 pm

and belief in congressmen in general. this is the chance to show that they want to represent the people of america and do something that would be great. >> i'm sure that it will be a december 31st, 11:59 kind of thing so that we can all be appreciative of the hard work they did. i think it should have been done a couple of months ago. >> come together, rise above, somebody's got to get the message between now and monday. tyler? >> thank you very much. you know, airline stock bucking the trend at their highest levels in more than a year. some of them up 20 to 40% this year so far. will their run continue in 2013? lebeau knows. plus, we get you in front of the numbers. which retailers did best and which ones failed to hit their numbers during the holidays? my name is rich mucin. i am the chairman, president, ceo of badger meter.

1:12 pm

we have 1400 employees around the world. the fiscal cliff is scary. another recision, higher unemployment, economic slowdown. tax money taken out of the economy. those are major concerns. we're going to have to react as a business and it could result in cut backs. the fiscal cliff was meant to be something that nobody wanted to go anywhere near and here we are about to go off it. we really need our elected officials to figure this out, keep our economy growing and gives us some certainty about the future so we can make our plans as business leaders. we're all having such a great year in the gulf,

1:13 pm

we've decided to put aside our rivalry. 'cause all our states are great. and now is when the gulf gets even better. the beaches and waters couldn't be more beautiful. take a boat ride or just lay in the sun. enjoy the wildlife and natural beauty. and don't forget our amazing seafood. so come to the gulf, you'll have a great time. especially in alabama. you mean mississippi. that's florida. say louisiana or there's no dessert. brought to you by bp and all of us who call the gulf home.

1:15 pm

welcome back. the dow jones industrial still down below 13,000. we're concerned about absolutely going over the fiscal cliff on monday. the nasdaq down 28 points. cisco systems is down nearly 2% as is bank of america down nearly 2%. look at that. reapproaching $12. that was one of the biggest winners of 2012 thus far. tyler? >> you know, michelle, airline stocks are up 20% so far this year climbing to a 1 1/2 year high. but will the skies be smooth for the industry. phil lebeau with a look at the airline sector 2013. >> reporter: in 2013 the merger dance between u.s. airways and american airlines will finally play out with a decision by the amr board and the creditors' committee early in the year.

1:16 pm

if the two airlines merng, they would challenge united for the title of largest airline in the u.s., but a merger may also signal a top for the airline stocks that have been steadily rising in 2012 in part due to speculation of consolidation in the industry. >> next year expect to pay a little bit more when you fly as airfares are projected to move slightly higher, but the biggest increase is the fees we'll be paying for everything from checked bags to services on the flight. >> reporter: speaking of being on board flights, 2013 may be the year we finally keep cell phones and electronic devices on while taking off and landing. increasing the leaders in the aviation industry and in washington are saying there's little evidence phones, ipads and computers will interfere tw a plane taking off or landing. even if that changes, don't expect the faa to decide it's okay to call and talk on your phone while in flight. and that's welcome news for all flyers. what else can we expect from

1:17 pm

the airline industry in 2013? basili lukasz covers the airline stocks. >> good morning. >> if you wanted to lose money, you invested in the airlines. that didn't turn out to be the truth in 2012. is that the same in 2013. do you think the rally continues? >> i don't think so. i think the way people made money in 2012 was investing in u.s. airways. there's a lot of euphoria surrounding the industry. it's going to become the next railroad industry. it will have amazing entries, that's hogwash. volume has outstripped since the recession. it wasn't much better than they did from the previous recession. >> american and u.s. airways, is that going to happen for sure? >> i think so. i wrote in june there will be a merger. u.s. airways has done an

1:18 pm

incredible job to cut costs. they need to look at amr. they have great international presence but too high of a cost structure. if you mary both carriers together you get the best of both worlds. >> i try to book a flight, more and more they're full, the prices are higher because of capacity rationalization as you call it. that's economic speak for it. they've gotten rid of a lot of routes and planes. there's fewer seats to buy. why isn't that ultimately good? that's got to be good for pricing. it sure feels like i'm paying more. >> yeah, absolutely. that's definitely been the case if you look at the numbers. i can give you an anecdote, i flew to new york for $195. cheap flight. airlines are selling a commoditi commodities parishable industry. if that seat goes unfilled it's lost revenue. i have a hard time believing when you have a company like southwest that wants to grow, you won't see any willingness to

1:19 pm

cheat or cut your prices in order to fill seats. >> so should people short these stocks, do you think? are they just flat? how far would you go? >> well, my view is u.s. airways is priced primarily on the merger potential. if you have a varying view that the merger won't go through, you can consider that from a short perspective. from the rest of the industry, i think they're fairly valued. i have a hold on all the stocks. it's a question of will the capacity pricing and discipline continue? i disagree. it's a commodity industry. there's nothing precluding them from starting new routes. yes, there have not been any new airlines recently but there are not any barriers to entry that i just don't see pricing power existing. >> all right. bascili, thank you so much. >> thanks for having me. tyler? >> thank you very much, michelle. airlines were big winners this year in the marketplace, so who were the big retailers and

1:20 pm

losers this shopping season. our jane wells knows for sure. jane? >> tyler, i'm out here at city walk. prepare yourself. i have something good to say about retail, including one store, the only store i have never shopped at. i didn't know one existed. we will have that after the break. >> announcer: if congress fails to intervene, over $1 billion will be cut from the afghanistan security forces fund which helps afghanistan to develop its own security forces. omnipotent of . you know how to mix business... with business. and you...rent from national. because only national lets you choose any car in the aisle. and go. you can even take a full-size or above. and still pay the mid-size price. i could get used to this. [ male announcer ] yes, you could business pro. yes, you could. go national. go like a pro. yes, you could. and you wouldn't have it any other way.e. but your erectile dysfunction -

1:21 pm

you know, that could be a question of blood flow. cialis tadalafil for daily use helps you be ready anytime the moment's right. you can be more confident in your ability to be ready. and the same cialis is the only daily ed tablet approved to treat ed and symptoms of bph, like needing to go frequently or urgently. tell your doctor about all your medical conditions and medications, and ask if your heart is healthy enough for sexual activity. do not take cialis if you take nitrates for chest pain, as this may cause an unsafe drop in blood pressure. do not drink alcohol in excess with cialis. side effects may include headache, upset stomach, delayed backache or muscle ache. to avoid long-term injury, seek immediate medical help for an erection lasting more than four hours. if you have any sudden decrease or loss in hearing or vision, or if you have any allergic reactions such as rash, hives, swelling of the lips, tongue or throat, or difficulty breathing or swallowing, stop taking cialis and get medical help right away. ask your doctor about cialis for daily use and a 30-tablet free trial. time for citi price rewind. because your daughter really wants that pink castle thing.

1:22 pm

and you really don't want to pay more than you have to. only citi price rewind automatically searches for the lowest price. and if it finds one, you get refunded the difference. just use your citi card and register your purchase online. have a super sparkly day! ok. [ male announcer ] now all you need is a magic carriage. citi price rewind. start saving at citi.com/pricerewind. .

1:23 pm

the markets are off their lows. at one point the dow was down 145 points. now down 107, almost 108. it's 13,006. the s&p 500 flirting at 1400. it's at 1407. nasdaq is off .8% at 2964, a 25 point low. what's the greatest performer? well, it is expedia up about $2 a share at $59.84. there you see the year-to-date total, better than a double on expedia. i'll put it up 6%. it turned out to be a rather weak holiday shopping season according to some early measures. did weather help or hurt, promotions help or snurt jane wells in l.a. getting in front of a lot of the numbers. hi, jane. >> hey, tyler. rumors of the death of holiday spending may be greatly

1:24 pm

exaggerated. a new gallup poll. gallup is a consumer spending surge last week into an average of $119. that's happening in between these winter storms with the sales going on. that is the highest spending right before christmas gallup has seen since it began tracking in 2008 and higher than the 103 bucks spent on the black friday. a couple of interesting winners according to craig johnson, william sonoma. he says it's difficult but williams and sonoma proper has been great. jcpenneys, then he named a smaller retail i have never been to because it's not out in california. >> one last one on the positive side, a small company, that's five. five below is a dollar store about 250, 300 units. very strong growth this year.

1:25 pm

they're targeted only at the teen and youth sector. moms like it. five below, it's been doing great. >> other winners johnson says, costco, urban outfitters, home depot, michael coeurs. names not performing as strongly as they have in the past, apple. the high end have struggled like sachs and nordstrom. a good season but not a great season. >> jane, thank you very much. where did you do most of your shopping? i'm just curious? >> i'll tell you the truth. amazon. >> amazon. >> i sat at my computer it was send it here, send it there, gift card this, gift card that. >> i think i used amazon more this holiday season than i have in the past as well. just sort of become engrained in all of our habits. thanks very much. >> it's easy. let's go for a market flash on a winning streak that's been put in serious danger. >> hey, ty.

1:26 pm

ford. look here. this stock has been on quite a winning streak. had a seven-day winning streak as of yesterday's close up 15% in that period, the longest such streak since last january. so nearly a year market giveth and the market taketh away. >> breaking news. conniflicting cliff reports. eamon jab beers standing by. >> hi, michelle. a little internet drama. it has a lot of folks excited. let me tell you what we know. senator scott brown, the disputed republican senator in massachusetts got everybody in washington a stir by posting on his facebook page within the hour, here's what he said. heading back to d.c. just learned that the pres reached out to senate gop leadership with a proposal.

1:27 pm

it is the first such proposal to be put forth. he said, hope it is serious. that got folks thinking that maybe president obama had made a new proposal up on capitol hill but that is now being shot down from all quarters, including from the white house where a senior administration official tells nbc news there is no proposal being sent up today. scott brown is wrong. and also a senior advisor to senator reid saying we are nowhere right now. so you can expect that whenever senator scott brown lands in washington, his blackberry is going to light up with a lot of people asking him questions about this facebook posting that now a lot of folks are saying is not true. so was there something that sparked that that's now not happening? we don't know at this point but that's what we have. >> i'll bet that's a good explainer of why we started to see the dow move off of its lows. eamon. we saw the dow start to climb back above the 13,000 level. looked like it was coming off the bottom. maybe it was the reports coming

1:28 pm

from scott brown. after eamon comes on we are moving lower. the lows, the do you down 148, right now we're down 135. minute-by-minute folks. coming up. retail stocks. we hope we'll have a lucky 2013. then senator reid speaking on our air. there's no time left, we're falling off the fiscal cliff. what happens if we do? what does it mean to the average american? we're going to break down the facts coming up. >> announcer: if congress fails to agree to a plan to avoid the fiscal cliff, it will result in $40 million in funding cuts for the maternal and child health block grant resulting in 5 million less families served. i got mine in iraq, 2003. usaa auto insurance is often handed down from generation to generation. because it offers a superior level of protection, and because usaa's commitment to serve the military, veterans and their families is without equal.

1:29 pm

begin your legacy, get an auto insurance quote. usaa. we know what it means to serve. your doctor will say get smart about your weight. that's why there's glucerna hunger smart shakes. they have carb steady, with carbs that digest slowly to help minimize blood sugar spikes. [ male announcer ] glucerna hunger smart. a smart way to help manage hunger and diabetes. with scottrader streaming quotes, any way you want. fully customize it for your trading process -- from thought to trade, on every screen. and all in real time. which makes it just like having your own trading floor, right at your fingertips. [ rodger ] at scottrade, seven dollar trades are just the start. try our easy-to-use scottrader streaming quotes. it's another reason more investors are saying... [ all ] i'm with scottrade.

1:31 pm

geeld prices closing now. bertha coombs, any reaction to the lack of a deal? >> a little bit. the golden ter day versus the geeld of the s&p. as we saw stocks move lower, gold edged higher. gold has been under such pressure this last quarter and this month in particular. gold on track for its 12th yearly gain, but it's the first time since 2004 that it's

1:32 pm

actually underperformed stocks. the last few years it's been big double digit gains. george gero over at rbc says you've seen a lot of fund liquidation no doubt because of tax liquidation and the fiscal cliff. you've seen open interest in gold decline this month. he's looking for 1650. we got close to that in the overnight session. as far as the rest of the metals, kind of a mixed bag today except for palladium. we've seen some fund buying and there's been concerns because of mine closures that we may see some small supply issues and demand may continue if we continue to see strong automobile sales. palladium and platinum used in catalytic converters. >> got it, bertha. trading action on the floor. mary thompson joins us. not looking good. >> it's not. this is a reality check. the markets have been holding

1:33 pm

pretty well and now that it appears -- >> they're waiting on a deal. >> we're not getting one. what you see is a triple digit decline on the dow jones industrial average. there are fears that we're heading over the fiscal cliff. the markets had weak data. consumer confidence for the month of november which, again, reflected concerns that we were headed over the fiscal cliff. the dow, nasdaq and s&p all negative for the month right now. as we take a look at the dow jones industrial average, the drags are cisco system, bank of america. the best performing stock on the dow for this year following its very poor performance in the prior year, alcoa also weaker along with jpmorgan and h hewlett-packa hewlett-packard. 50 day average, when it breaks below that on decent volume, the down side the traders are watching the levels as we came into today's session. groups that are leading the s&p

1:34 pm

lower are financials which are the best performing sector of 2012. taking a turn south in today's session. energy and materials actually also joining the fray among the leading laggers within the sectors that we followed. we also wanted to point out jcpenney. it was an outlier and today it reverses. it's having its worst day in six weeks, i believe. the reason being there was an article in the wall street journal saying it's a do or die year for jcpenney. >> wow. that was an intraday chart. normally they fall and then they hold. this thing looks like a ski slope. getting worse and worse as the session goes on. >> yes. >> thank you, mary. in terms of percentage declines, the nasdaq is the biggest winner or loser. seema mody, following the winners. >> seems like investors are following the developments or lack of developments out of washington. that's what's weighing on the nasdaq. we're down about a percent. large cap tech. google down a percent. apple down a similar amount.

1:35 pm

two headlines to watch on shares of apple, holiday retail survey shows customer satisfaction with apple's online stores slipped to the lowest score in four years. traders say shares of apple seem to be hitting a resistance of 514. then moving lower. that's one pattern to watch out for. in the semiconductor, marbel lost 10% on the jury's verdict on a patent infringement case. they downgraded the stock writing that this legal development calls into question its valuation safety net. if you're looking for some bright spots, take a look at expedia. shares moving higher. there doesn't seem to be any news helping to lift the stocks. however, when talking to traders the stock looks attractive on a technical basis. that's what i'm hearing on the street. lastly, take a look at deckers outdoor moving higher on some strong volume. ugg boots were listed as one of the holiday best sellers on

1:36 pm

amazon.com. perhaps that's what's helping the stock move higher. up almost 9%. back to you. thank you, seema. rick santelli, you're going to be aghast when i say this. i haven't actually paid a lot of attention to the treasury market today. i am going to guess that as people are selling stocks they are buying bonds, is that the case? >> ding, ding, ding. give that young lady a cupie dom. we're down a handful full of bases points. we're down 17 bases points on the year hovering at the yield. we would have a two-week low yield close as you can see on the three-week chart. let's switch gears to foreign exchange. we look at the dollar index year to date. we're still down on the year on the dollar index. that isn't a surprise. it may be a bit of a surprise considering how big the gains against the yen are. it isn't just the dollar. pretty much every currency.

1:37 pm

look at this three-year chart of the dollar yen. we are now comfortably above 86. it's been trading above it for a while now. a 29-month dollar high. tyler? >> all right, rick. thank you very much. so which retailer is favorite among consumers? amazon named the top website for shopping online for the eighth consecutive year according to four c's latest survey. jcpenney suffered the largest drop. amazon pleasing well, shares up 38% over the past one year. so what other retailers will likely have a lucky year in 2013? joining us with her picks from london is stacy widlids. president of sw retail advisors. hi, tyler. >> you were here the other day. you left me a nice present. >> i was. >> now you're back in london. oh, my goodness. that's fantastic. anyhow, let's talk about three of your picks beginning with limited brands, which you have some very complimentary things

1:38 pm

to say about. >> sure. well, i think as you look to 2013, in the past couple days retail stocks are getting clobbered. so let's take a look at a few retailers that might outperform in 2013 started with limited. first of all, they're talking about a 20% operating margin go up from 15. second, if you just look at the numbers over the past year, this has been one of the most consistent outperformers. they brought in continual newness and they've done that by chopping lead time on product. so i think this is the stock that you want to take a look at and just to add on to that, they've just opened in london a flagship store several months ago. it's doing phenomenally well. they're taking international slow and the u.s. business is hitting a home run. i would continue to look at that stock. >> remind me, stacy, what their key brand stores are. >> so it's victoria's secret, it's pink. so those are the two brands. bed, bath and body. so, you know, the lingerie

1:39 pm

business, but it's all about bringing the newness in, and that's what's been working for them. >> all right. your second choice as it was, i believe, for much of last year, was macy's? >> yes. again, macy's is also taking it on the chin a little bit this week as everybody's worried about that master card data which, you know, is putting a damper on potential retail sales for the holiday. macy's is certainly one of the retailers that's been a leader in the omni channel approach. integrating the stores with online, that's been working for them here. also, i don't know if you've seen their commercials. they're doing a post christmas week of wonderful campaign. what they're doing is bringing in new products in addition to having the clearance. that's what worked in 2012. it's all about the new product, exciting the consumer and getting them in the store. that's what they're doing along with giving an incredible value proposition. that's resonating with the

1:40 pm

consumer. >> i have two favorite stores, stacy. one is sax and the other is your third choice, nordstrom. why? >> okay. well, sorry, sax business sounds like it's into the great this holiday. we've heard some very negative things out of that channel so you'll get some good bargains, tyler. turning to nordstrom. again, nordstrom was one of the retailers to invest first in terms of their technology with inat the greating online and stores and that's done very well for them. online last quarter was up 38%. >> wow. >> they're also working on the store experience. i think finally, they have the rack nordstrom off price channel. the off price channel has been one of the best performers over the past year. they have exposure there and they said they can double their store base in that off price channel. so i think you get a luxury player and an off price player merged and that's a winning combination for 2013. >> one of the notes we just put

1:41 pm

there it said they also have a partnership with top shop which could be a disrupter in the retail business. quick thought? >> they do. here in the u.k. top shop is killing it. best traffic in retail. top shop is dipping its toe into the u.s. market so everybody from the gap to fact fashion should watch out. they have a partnership with nordstrom. that's going to be a win. and, tyler, you can even get a tattoo or hair extensions. >> just what i wanted for the new year. >> it's coming your way. >> that's what i want. >> that's for2013. >> all right, stacy. thanks. have a great new year, okay? >> thanks. you too. >> hey, michelle. i'd love to see you in a tattoo. all right. >> bad. >> more days four days -- four days and counting. harry reiry reid says the u.s. probably going over the fiscal cliff. >> would it be betser for america if we did go over the fiscal cliff? coming up?

1:42 pm

1:43 pm

at a dry cleaner, we replaced people with a machine. what? customers didn't like it. so why do banks do it? hello? hello?! if your bank doesn't let you talk to a real person 24/7, you need an ally. hello? ally bank. your money needs an ally. you won't take our future. aids affects us all. even babies. chevron is working to stop mother-to-child transmission. our employees and their families are part of the fight. and we're winning. at chevron nigeria, we haven't had a reported case in 12 years.

1:44 pm

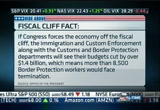

aids is strong. aids is strong. but we are stronger. and aids... ♪ aids is going to lose. aids is going to lose. ♪ coming up, we'll see how correct or in correct our predictions were for this year. we'll check in on commodities. we've also got a mystery panel today. it is a retail stock that has not had a down q1 for the past nine years. that is your hint. what on earth is happening in washington, folks? when we run through what exactly no deal means for you step by step just how annoyed are you going to feel? lots of things coming up on ""street signs."" >> i'm annoyed, mandy. four days to go before america goes over the fiscal cliff.

1:45 pm

what does that really mean for average snerns how would going over the cliff affect you? jackie deangel lis is at cnbc hears. >> four days away, not a lot of time at all. a lot is at stake for all-americans if washington can't come to some sort of agreement before the deadline. while some groups will be impacted differently, the key here is that everyone will be paying more. consider those who make roughly $20,000 a year or less. they'll be paying on average $412 more. if your salary is in the $64,000 range, you're going to be paying almost $2,000 mosh. remember, that's why president obama was talking about my 2 k. he wanted to get the middle class to weigh in on the tax debate. that's how much they'll be paying. if you make a little bit over $100,000, you'll see an average hike of $3500. let's get to the higher category and income earner.

1:46 pm

households making half a million a year, they'll contribute about $15,000 a more. of course they're the top earners, the .1%, on average they'll see hikes of more than $633,000. income taxes are not the only major issues here. we go over the cliff, the tax rate on most capital gains would go from 15 to 20%. dividends would now be taxed like regular income instead of capital ganls. the inheritance tax, that would go from 35% on estates over $5 million to 55% on estates over a million bucks. so a lot of implications here not just on regular income taxes. michelle. >> got it, jackie. good way to lay out the situation. investors acting on their fiscal cliff nerves. this is the first time since the dow has dipped. a deal has been priced in. a lot of people thought something was going to happen. harry reid said we're probably going over the cliff. check out the wall street fear index. they have spiked above 20 for

1:47 pm

the first time since july. if this is what we're facing, how much worse can the fall get? jackie laid it all out, right? the average individual will have a lot less money to spend and we are a consumer-driven economy. a lot of action down there on the floor. >> people excited. >> is the market acting in a way that surprises you or down the surprise you based on the fact that it looks like we're going to go over? >> it's not acting in any way i shouldn't think it should, let's put it that way. what was surprising was last week's rally. we knew we were going to come into this. oil is rising. >> there was a lot of coombaya. we're still talking. >> right. >> they're not talking. >> it's a bit like christ mags shoppi -- christmas shopping. they're getting paid to do it. it might be better if we do. if we do go over the cliff, things have to get done and they have to get done in substantive

1:48 pm

manner. instead of putting a band aid over this, this is substantive stuff. we're relying on people we don't have confidence in. >> matt, i've got two hours left in today's trade. i've got tomorrow and i've got monday. if i have a stock that i've been thinking of selling, should i sell it? >> well, you know, i think all day today people have been saying they've unwinded all of their positions, they're flat going into the new year. i think that's the prudent thing to do. why take a risk and hold something if we're going to be taxed more on it. sell it now. see what happens. you can always get back into the market. there are plenty of stocks that haven about ebeen depressed. >> i have to think too, interest rates. we have talked about whether the treasury bubble was bursting. if we go over the cliff, the economy gets worse, interest rates continue to stay very, very low, right? >> that's a positive. obviously you're starting to see, you know, gold the way it's acting, the yen, the dollar the

1:49 pm

way it's acting. there are definitely plays if you want to do it and take a shot, take the risk and put some trades on. why would you do it right now? everyone is so risk adverse. stay risk adverse going into 2013. let these people sort it out in d.c. it may take months. >> that's such a strong word. thank you, matt. time is money in the windy city. chicago will have the priciest parking meters in the entire country. stay tuned to find out just how much they're going to charge in the new year. >> announcer: if congress forces the economy off the fiscal cliff the immigration and custom enforcement along with the customs and border protection departments will see their budgets cut by over $1 billion which means 8500 border protection workers would face termination. get married, have a couple of kids, [ children laughing ] move to the country,

1:50 pm

and live a long, happy life together where they almost never fight about money. [ dog barks ] because right after they get married, they'll find some retirement people who are paid on salary, not commission. they'll get straightforward guidance and be able to focus on other things, like each other, which isn't rocket science. it's just common sense. from td ameritrade. it's just common sense. ...so as you can see, geico's customer satisfaction is at 97%. mmmm tasty. and cut! very good. people are always asking me how we make these geico adverts. so we're taking you behind the scenes. this coffee cup, for example, is computer animated. it's not real. geico's customer satisfaction is quite real though. this computer-animated coffee tastes dreadful. geico. 15 minutes could save you 15 % or more on car insurance. someone get me a latte will ya, please? in that time there've been some good days. and some difficult ones. but, through it all, we've persevered,

1:51 pm

1:52 pm

all right. power rundown time. michelle is with us, kayla too. first up, the fiscal cliff just four days away. it doesn't look like anybody is rising above. at least not as far as i can tell. would it be better, i'm not sure better than what, if we just went over the cliff. michelle? >> you know what, i'm beginning

1:53 pm

to think so, tyler, based on what we said at the top of the show and the following. during this whole process i asked democrats, hey, listen. if the republicans raise taxes on everybody that you want them to, would you at least means test medicare for millionaires. the vast majority says no. i asked republicans, hey, if the democrats had an epiphany and they said we think democrat ryan is right, would you raise taxes on millionaires? they say, no. so there's no middle ground even if you get nirvana on both sides. it's ridiculous. i'm tired of it. >> clkayla? >> tyler, is the right thing to encourage washington yet again that rules and deadlines are made to be broken? at this point that's what they believe. this would be yet another example of that. i don't think that's good for the long term. >> the stupid way from my perspective to do fiscal policy, but the fact of the matter is i think it's bad in the sense of what it says about our leadership, that the leadership can't lead and that they have to

1:54 pm

use these kinds of blunt instruments. but i will survive it no ma ter what happens. let's go to today's yahoo financial information. is the worst over for housing as some people are on track for some yearly gains. 42% said no. kayla, what do you think? >> tyler, we definitely saw the price recovery start with the prices increased for the last year. that's a good thing. that's a statistical recovery right there, but the issue of supply and demand. you have fewer sellers and the same amount of buyers by definition. you'll see prices go up in that environment. a lot of people are not willing to sell. they say the price of my home is still down big time. prices need to go up. >> home prices are in the eyes of the beholder, right? if you're still underwater, you need a dramatic increase in the price of your home in terms of

1:55 pm

percentages to get back to even. those people aren't going to feel like things are off the bottom. definitely i've seen here in new york city bidding wars on apartments. there have been improvements in some parts of the country. >> the market is percier. i still feel like a loser because of, kayla, what you were saying. i'm still down from where i was. >> you don't want to sell. >> right. anyhow, let's talk about chicago. i'll be there next week with the morning star mutual manager fund of the year. i'm going to find that chicago is going to have the most expensive parking meters in the country. $6.50 per hour down on the loop. four years ago most of the windy city's parking meters cost just 25 cents per hour. this is demand pricing, isn't it, michelle? >> i love it. you let prices clear the market. if anybody wants to complain about that, then you just have people circling the block over and over again 256789 cents was obviously way too low. >> kayla, where are you going to put all those quarters? >> i don't know.

1:56 pm

i think people have to start using sacajawea coins again. i don't know if we make those again. why do they have an interest in talking about chicago parking meters and why they're the most expensi expensive. new york is getting a bad wrap for being the most expensive. there's a max in manhattan, $3 per hour. >> that's why there's not enough of it. if they raised the prices it would be easier to find a space. >> i'm with you on that. in the next hour the frequent flyer cliff. how to hold on to your airline first in '13 plus the retail stock that has been up every quarter in the first quarter for the last nine years. surprise there. we'll be right back. i got mine in iraq, 2003. usaa auto insurance is often handed down from generation to generation. because it offers a superior level of protection, and because usaa's commitment to serve

1:57 pm

the military, veterans and their families is without equal. begin your legacy, get an auto insurance quote. usaa. we know what it means to serve. omnipotent of opportunity. you know how to mix business... with business. and you...rent from national. because only national lets you choose any car in the aisle. and go. you can even take a full-size or above. and still pay the mid-size price. i could get used to this. [ male announcer ] yes, you could business pro. yes, you could. go national. go like a pro. you won't just find us online, you'll also find us in person, with dedicated support teams at over 500 branches nationwide. so when you call or visit, you can ask for a name you know. because personal service starts with a real person.

1:58 pm

[ rodger ] at scottrade, seven dollar trades are just the start. our support teams are nearby, ready to help. it's no wonder so many investors are saying... [ all ] i'm with scottrade. you can stay in and share something... or you can get out there and actually share something. ♪ the lexus december to remember sales event is on. this is the pursuit of perfection. your doctor will say get smart about your weight. that's why there's glucerna hunger smart shakes. they have carb steady, with carbs that digest slowly to help minimize blood sugar spikes. [ male announcer ] glucerna hunger smart. a smart way to help manage hunger and diabetes. c'mon, michael! get in the game! [ male announcer ] don't have the hops for hoops with your buddies? lost your appetite for romance? and your mood is on its way down. you might not just be getting older. you might have a treatable condition called low testosterone or low t.

1:59 pm

millions of men, forty-five or older, may have low t. so talk to your doctor about low t. hey, michael! [ male announcer ] and step out of the shadows. hi! how are you? [ male announcer ] learn more at isitlowt.com. [ laughs ] hey! welcome back. we still have a triple digit loss on the dow. 1% declines across the board. let's show you some gainers. hopefully you own some of these. a lot of small caps here. these are percentage gainers. new skin, bbc energy. tyler, i'm doing the kudlow show. you can be sure

177 Views

IN COLLECTIONS

CNBC Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11